washington state capital gains tax vote

OLYMPIA Earlier today the Washington State Legislature approved a critical piece of tax reform legislation. First of all its just a straight-up repeal meaning that it would scrub Washington law of all mention of Senate Bill 5096 from last year eliminating the 7 percent tax on most capital gains over 250000 which is expected to bring in about 500 million per year when its fully implemented¹.

Democrats Tweak Tax Bill For House Vote Grant Thornton

The bill is part of a multi-year push by the legislature to rebalance a state tax.

. OLYMPIA Washington voters were rejecting a state advisory measure to adopt a new 7 tax on capital gains above 250000 in Tuesday nights election results. The realization of capital gains slid 71 percent between 2007 and 2009 55 percent in 1987 and 46 percent in 2001. Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the.

The answer from voters by a wide margin was no with a vote of 63 to 37. On Saturday the Senate narrowly passed legislation by a vote of 25-24 to establish a capital gains tax. Heading into session there were two proposals for a capital gains tax HB 1496 in the state House and another in the state Senate SB 5096 requested by the Office of Financial Management which.

The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. Washingtons advisory votes are. The new law will take effect January 1 2022.

June Robinson D. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income. SEATTLE - Voters will weigh in on Washington states new capital gains tax on high-profit.

Washington Enacts New Capital Gains Tax for 2022 and Beyond. W ashingtons first capital gains tax is one step closer to becoming law after surviving two dozen amendments by the Senate Ways and Means Committee on Tuesday. The sponsor filed multiple versions of the initiative and some.

June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the children of Washington. An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov. June Robinson D-Everett would establish a capital gains tax of 7 percent on capital gains that exceed 250000 in a given year.

The bill now heads back to the Senate for final concurrence. After several hours of debate the House passed the Senates capital gains tax bill Wednesday in a 52-46 vote bringing Democrats one step closer to rebalancing Washingtons tax code. Engrossed Substitute Senate Bill 5096 sponsored by Sen.

5096 which was signed by Governor Inslee on May 4 2021. Under the unusual dynamics of the COVID-19. A narrow approach.

The bill imposes a seven percent tax on capital gains in excess of 250000 realized from the. The narrow 25-24 vote followed a nearly four-hour. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022.

Earnings from retirement accounts and home sales. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session. OLYMPIA Profits on the sale of stocks and bonds in excess of 250000 would be subject to a new tax on capital gains under a bill narrowly approved Saturday by the Washington Senate.

Senate Bill 5096 sponsored by Sen. The video above aired May 4 2021 when Washingtons capital gains tax was signed into law. Majority Democrats in the Washington Senate passed a capital gains tax bill - something thats been talked about for a decade - over the weekend.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. The Sunday vote on the capital gains bill mostly along party lines primarily targets stock and business ownership sales with a 7 tax for the first time in. This initiative would repeal a 7 capital gains tax that was set to begin being collected in 2023.

Advisory Vote 37. Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly volatile.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

Biden To Propose Capital Gains Tax Hike To Fund Education Child Care Reports

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

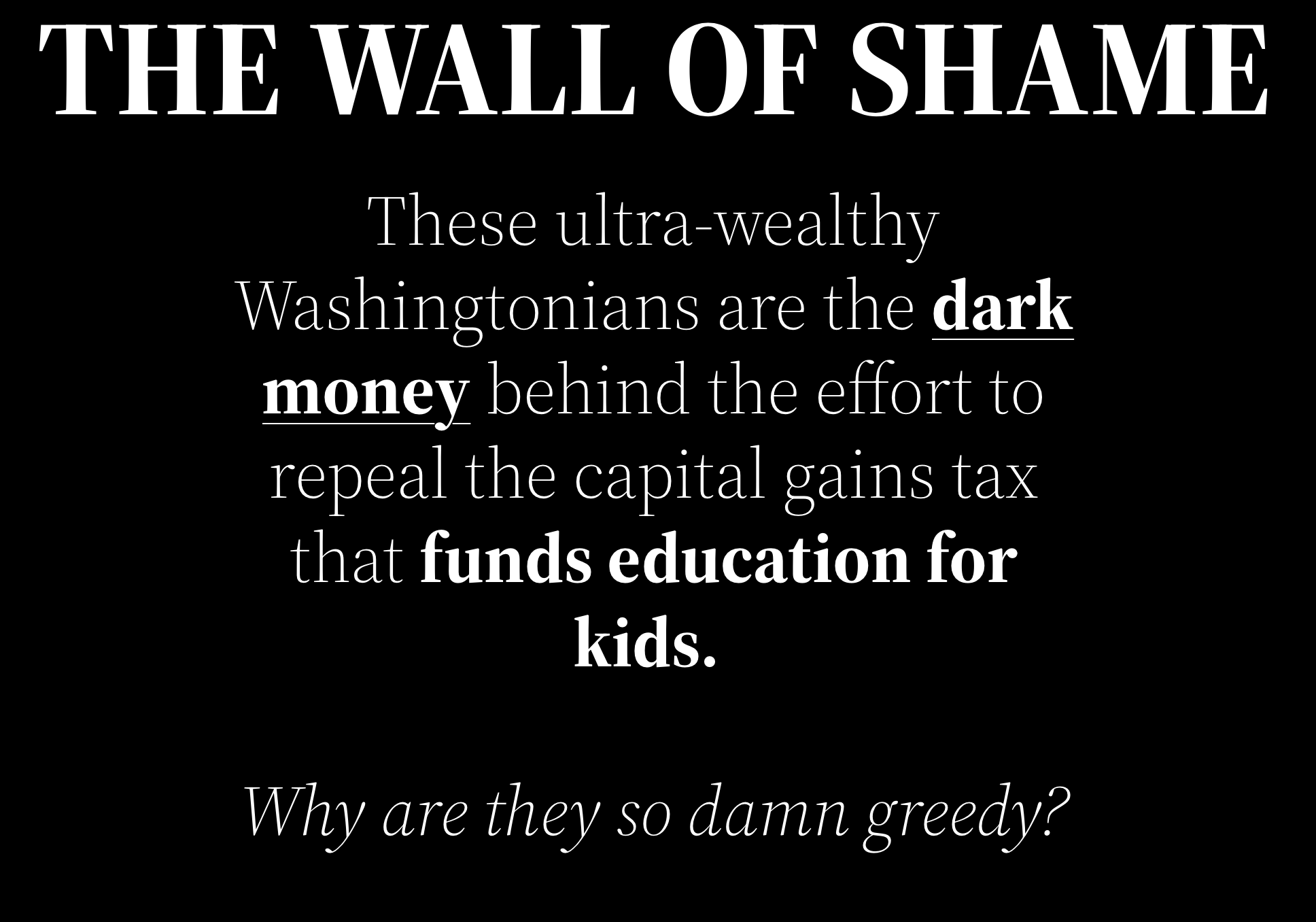

Repealing The Capital Gains Tax Is A Long Shot Slog The Stranger

Washington State Passes New Capital Gains Tax The Hill

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

The Real Capital Gains Tax Repeal Initiative Appears Washington State Wire

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

Democrats Divided Over Tax Proposals To Pay For Budget Bill The New York Times

Democrats Divided Over Tax Proposals To Pay For Budget Bill The New York Times

The Real Capital Gains Tax Repeal Initiative Appears Washington State Wire

New State Laws For 2022 Expand Voting Rights Create Capital Gains Tax And More South Seattle Emerald

Washington Advisory Vote 37 Nonbinding Question On Capital Gains Tax To Fund Education And Child Care 2021 Ballotpedia

Washington State Kicks Off Major Tax Fight With New Capital Gains Levy The Hill

Repealing The Capital Gains Tax Is A Long Shot Slog The Stranger

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times